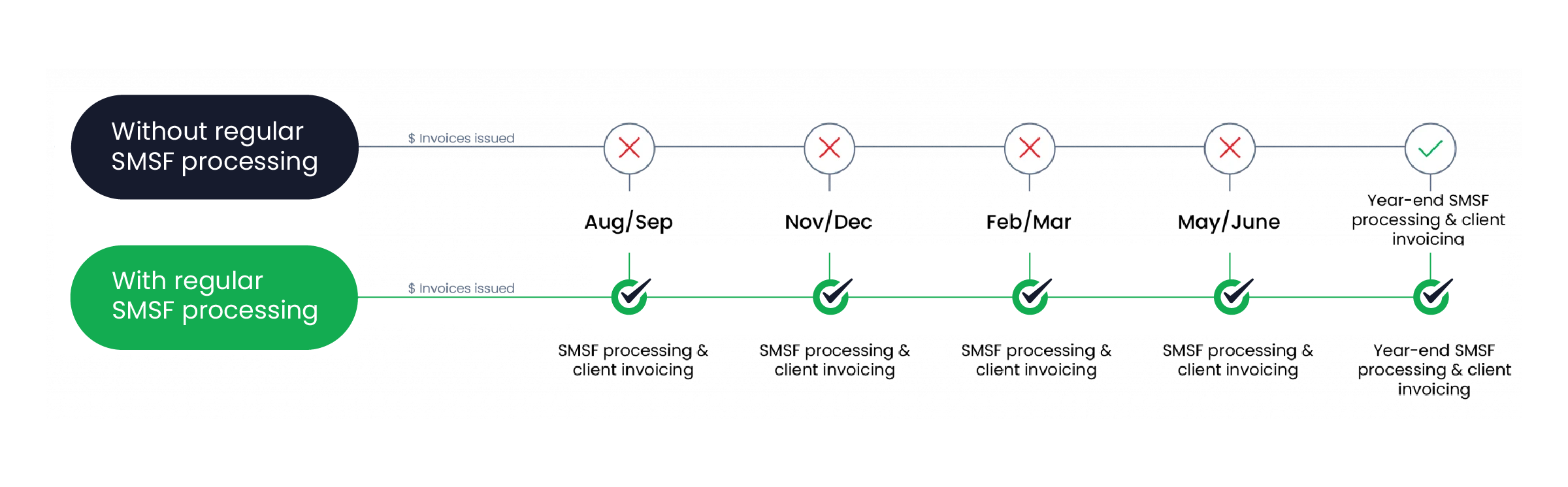

Traditionally, SMSF administration has been treated as a reactive, annual compliance event. For many firms, this results in the familiar “June 30 hangover”; months of compressed workload, stressed staff, and revenue that is locked up in WIP until the job is finally billed.

While this model is familiar, it is operationally inefficient. It creates cash flow volatility and limits your firm’s capacity to scale.

The industry is shifting. By moving to Regular SMSF Processing, forward-thinking firms are transforming SMSF administration from a seasonal burden into a stable, high-value annuity stream.

What is Regular SMSF Processing?

Regular SMSF processing is the strategic shift from annual “shoe-box” data entry to a continuous workflow. It involves reconciling transactions and processing data on a monthly or quarterly cycle, alongside interim reporting.

It does not increase the overall workload; instead, it redistributes that work evenly across the year. When approached strategically, regular processing should not be seen as a burden, but as a reliable, recurring revenue stream that supports predictable cash flow and better capacity utilisation.

The Commercial Impact: Annual vs. Regular Processing

The difference isn’t just operational; it is financial. Here is how the two models compare on key commercial metrics:

The Strategic Benefits of Regular SMSF Administration

Periodic SMSF processing offers numerous benefits in addition to the predictable revenue stream spread throughout the year. Some of the advantages of regular transaction processing include:

- Unlocking Cash Flow & Valuation: Regular SMSF processing enables practices to move away from one-off annual invoices and adopt fixed monthly or quarterly billing. This creates predictable revenue, improves cash flow, and supports a more stable financial position. More importantly, it shifts SMSFs from “compliance jobs” to annuity-style income streams.

- Scalability Without Burnout: Regular processing also ensures better utilisation of resources throughout the year. This drastically reduces staff burden at the end of the year and enables better forecasting of staffing needs. Additionally, there is less reliance on seasonal or contract hires and lower overtime costs during peak months.

- Elevating the Client Experience: Regular SMSF processing delivers ongoing value to clients by providing clearer, up-to-date visibility of their fund’s position throughout the year. Issues are identified and addressed earlier, year-end outcomes become more predictable, and clients experience fewer surprises. This proactive approach positions the firm as a trusted, year-round partner rather than a once-a-year compliance provider.

- Audit Efficiency as a Standard: When SMSFs are processed regularly, auditors receive cleaner and reconciled data, resulting in fewer queries and resubmissions. Regular SMSF processing leads to shorter audit turnaround times.

Is Regular SMSF Processing Mandatory for AU Firms?

Regular SMSF processing is not mandated by the ATO. However, the trustees must maintain accurate records. Only processing and invoicing annually leads to risk accumulation at the end of the year, causing hurried corrections, increased error rates, and avoidable delays during year-end compliance and audit.

Regular processing is not just a workflow preference; it is a risk management strategy. It ensures that when the audit rolls around, the fund is compliant by design.

Why Regular Processing Scales Better with Outsourcing

Implementing a monthly SMSF processing cycle requires discipline and consistent capacity; resources that are often scarce in busy firms. This is where SMSF outsourcing becomes a strategic lever.

Regular processing is process-driven and repeatable, making it the perfect candidate for a specialised offshore team like SuperRecords.

- Consistency: Offshore teams are not distracted by local ad-hoc advisory work; their sole focus is maintaining the ledger currency.

- Scalability: You can add volume to your books without needing to recruit and train new local staff.

- Profitability: By leveraging SuperRecords’ infrastructure, you lower the cost of production, improving the margin on your fixed-fee packages.

Is your firm ready to smooth out the seasonal spikes and build a more valuable SMSF book?